In the News: Associate Professor Ricky Volpe

Independent grocers could lose share to Kroger, Amazon amid coronavirus

crisis

7 May, 2020

Author - Alexander BitterKatie Arcieri

Theme - Retail & Consumer Products

Original Article - https://www.spglobal.com/market-intelligence/en/news-insights

The coronavirus crisis is presenting new challenges to independent grocers in the United States, which could cede market share to Amazon.com Inc. and other large national players better equipped to handle increased demand and supply-chain disruption.

These independent supermarkets are smaller, localized grocers that lack the national and regional footprints of companies like The Kroger Co., Walmart Inc. and Amazon, which owns Whole Foods and is building out a new grocery store concept.

The pandemic is testing smaller retailers of all stripes, from mom-and-pop operations to local chains and specialized, niche grocers. As customer demand for delivery has surged during the outbreak, grocers of all sizes are scrambling to keep shelves stocked with essentials such as eggs and meat. But those challenges tend to be even more daunting for smaller grocers, said Ricky Volpe, a professor in California Polytechnic State University's Agribusiness Department.

The impact of the coronavirus pandemic has increased the risk of smaller stores ceding market share to larger players, Volpe said. "This will culminate in at least a short-term bump in market concentration levels" in the U.S. grocery industry, he added.

Collectively, independent grocers account for one-quarter of annual U.S. grocery spending, according to the National Grocers Association, a trade group that represents independents. But the group is diverse: A 2017 report from the U.S. Department of Agriculture's Economic Research Service estimated that grocers with fewer than four stores made up 11% of U.S. grocery sales in 2015.

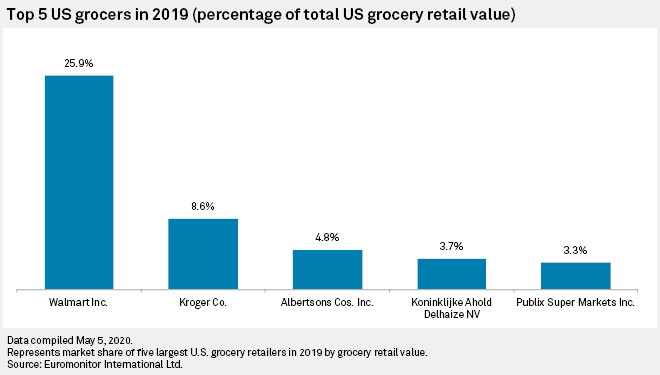

By contrast, Walmart accounted for nearly 26% of U.S. grocery sales in 2019, while Kroger represented 8.6%, according to Euromonitor.

The risk these smaller grocers face could enable companies like Amazon to capitalize on any losses, whether it is picking up e-commerce grocery sales or taking over an independent grocer's physical store, said Jason Goldberg, chief commerce strategy officer at Publicis.

"This pandemic creates an opportunity for Amazon," he said in an interview. "It's now going to be easier for them to capture more share, and more affordable for them to potentially acquire retailers or their real estate or their assets."

Grocers of all kinds are revising their supply chains for basic grocery items such as meat as production and sourcing become more difficult. Those challenges are all the more difficult for small players, especially in urban and suburban markets with lots of competitors, Volpe said.

"The companies that are able to keep their supply chains running are the ones who are going to be able to see their market shares rise in the long term," he said.

Big public companies have multiple ways of raising money to invest in new services and projects, like Walmart's push to expand two-hour delivery to 1,000 stores by early May and Amazon's plans to expand its brick-and-mortar network with a new grocery format. Unprepared for change

But grocers that operate at a smaller scale often lack those resources, said Keith Daniels, a partner at Carl Marks Advisors who works with regional and independent grocers. That can leave them unprepared for changes brought on by the pandemic.

"It's going to be tough [for smaller retailers to] catch up in some respects," Daniels said.

Goldberg, of Publicis, said independent grocers are often cash-strapped in a crisis and unable to pivot as quickly to delivery and pickup options that now are an important part of grocers' e-commerce strategy. "Most independent grocers have 19 days of available cash," Goldberg said. "If their income is significantly disrupted for 19 days, then they're in financial jeopardy."

Like all grocers, independents are also faced with added costs to protect their front-line workers and pay them higher wages and overtime. These costs hit their bottom line harder than their larger counterparts. "They all add cost," Goldberg said. "While there is a slight uptick in sales for a typical grocer, their profits have actually gone down."

Customers stocking up on essentials have helped to power sales at Buehler's Fresh Foods, according to CEO Dan Shanahan. The Wooster, Ohio-based chain operates 13 stores and has seen sales volumes through its drive-thru pickup business triple since mid-March, he said. Buehler's has also started publishing weekly data on store traffic so that customers can shop during less busy hours.

But keeping some products, such as frozen vegetables and flour, has proven difficult, he said. The grocer has also taken a hit from the closure of its catering business, and a timeline for taking orders again is unclear. "I don't know how that's going to shake out," he added.

James McCann, CEO of McCann Investments, which invests in early-stage grocery tech companies, said small grocers lack the wherewithal to create their own e-commerce solutions.

That means they have to team up with third-party companies like Instacart and ShopHero, a startup that provides e-commerce and fulfillment services to independent grocers, he said.

"If they don't do it, then that customer just leaves anyway," McCann said. "On the other side of it, if they've got a system and they are able to pick efficiently, and they can get more pickup than home delivery or they can charge for the delivery and the picking up, then they've got a solution. They can make it work."